Loan Settlement · 3 min read

Breaking the Cycle: Understanding Payday Loans and How to Settle Them

Payday loans may offer quick cash, but they come with high interest rates and serious risks. This blog explains what payday loans are, how to settle them, and safer alternatives. Learn your legal rights, smart repayment strategies, and how to break free from the debt cycle. Get informed before you borrow—your financial stability depends on it.

1. What Are Payday Loans? Understanding the Basics

Payday loans in India are high-interest, short-term credit facilities that assist the borrower in paying for immediate needs until the arrival of the next paycheck. They are usually unsecured, involve minimal documentation and no collateral, and are hence available to borrowers with little credit history. Convenience is, however, expensive, with interest charges between 30% and 50% annually, depending on the lender's and borrower's profile.

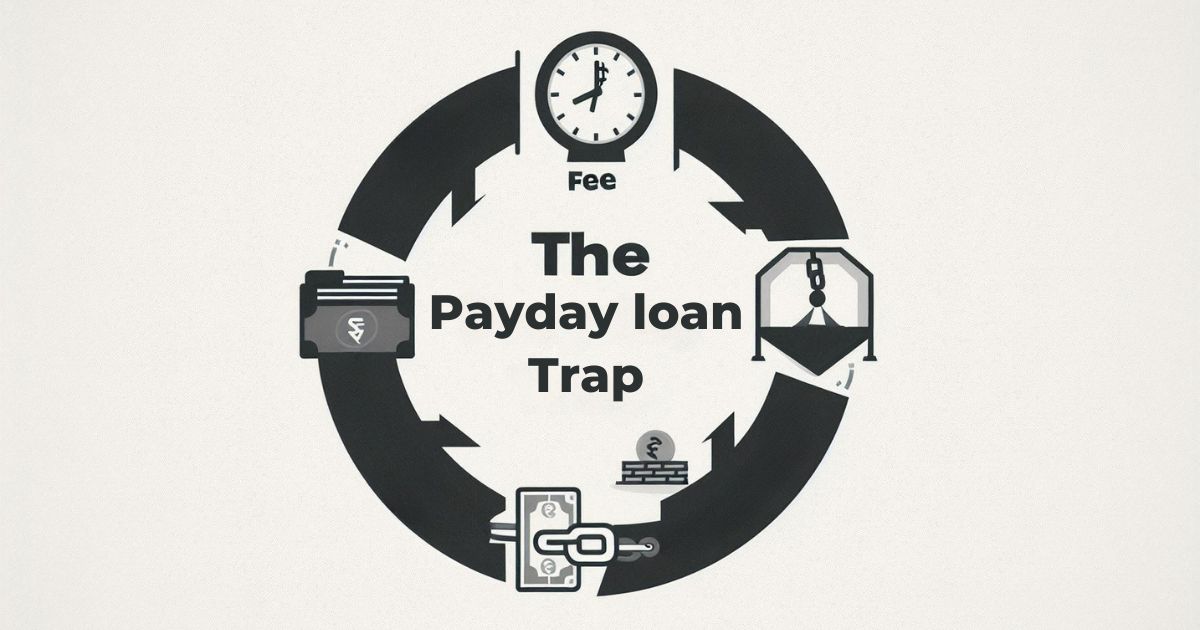

2. The Payday Loan Trap: High Interest and Hidden Risks

Even though payday loans provide immediate financial relief and are easily accessible, they have been found to fuel excessive debt since they carry high interest rates and very short repayment cycles, usually ranging from 7 to 30 days. Missed repayments can attract extra charges, extra interest, and coercive recovery techniques. In addition, some online lenders lend without following proper regulations, putting the borrower at the mercy of predatory lenders and market ambiguities.

3. Can You Settle a Payday Loan? Negotiation Strategies Explained

Yes, it is possible to settle a payday loan in India. Settlement means negotiating with the lender to pay less, essentially closing the loan account. Here's how you can do it:

● Assess Your Financial Situation: Decide how much you can pay as a lump sum or in installments.

● Contact the Lender: Inform the lender of your financial difficulty and willingness to pay off the debt.

● Negotiate a Settlement Amount: Lenders can accept part of the total amount owed. Settlements are usually between 30% and 70% of the original amount.

● Get the Agreement in Writing: Make sure all conditions are put into writing to eliminate future conflicts.

● Make Timely Payments: Follow the agreed-upon payment timeline to avoid additional issues.

In addition, professional companies such as Lawyer Panel and Expert Panel specialize in loan settlement and debt relief and provide support to borrowers in need of financial help.

4. Legal Rights and Protections for Payday Loan Borrowers

The Reserve Bank of India (RBI) has introduced guidelines to oversee digital lending and safeguard customers against predatory operations. These involve requirements for transparency in loan terms, interest rates, and recovery procedures. Additionally, the Indian government has introduced legislation mandating severe penalties, including imprisonment and fines, for illegal lending operations. Borrowers must check the authenticity of lenders and report any harassment or illegal activity to the right authorities.

5. Breaking Free: Intelligent Alternatives to Payday Loans

To escape the traps of payday loans, look at the following alternatives:

● Personal Loans from Banks: Traditional banks issue personal loans with rates from 10.30% per annum, offering longer payment terms.

● Credit Union Loans: Some credit unions offer small, short-term loans at lower rates to their members.

● Debt Management Plans (DMPs): Nonprofit credit counseling organizations are able to combine and lower debt through formalized repayment schedules.

● Employer Salary Advances: Salary advances or brief loans are given by some employers to employees.

● Emergency Funds: Creation of an emergency fund can supply a financial cushion, lessening the need for high-interest loans.

What is the Bottom Line?

Grasping the complexity of payday loans and examining settlement possibilities can help borrowers regain financial stability. Staying aware, consulting experts when needed, and opting for more secure financial solutions can help them navigate financial setbacks successfully.

.L3B2P26q.jpg)

.kYF4YWoS.jpg)