Negotiating Relief: Easing Repayment Burdens

Learn how Indian borrowers can ease debt stress through lender negotiations, one-time settlements, and restructuring—practical steps to regain control and avoid legal or financial trouble

Learn how Indian borrowers can ease debt stress through lender negotiations, one-time settlements, and restructuring—practical steps to regain control and avoid legal or financial trouble

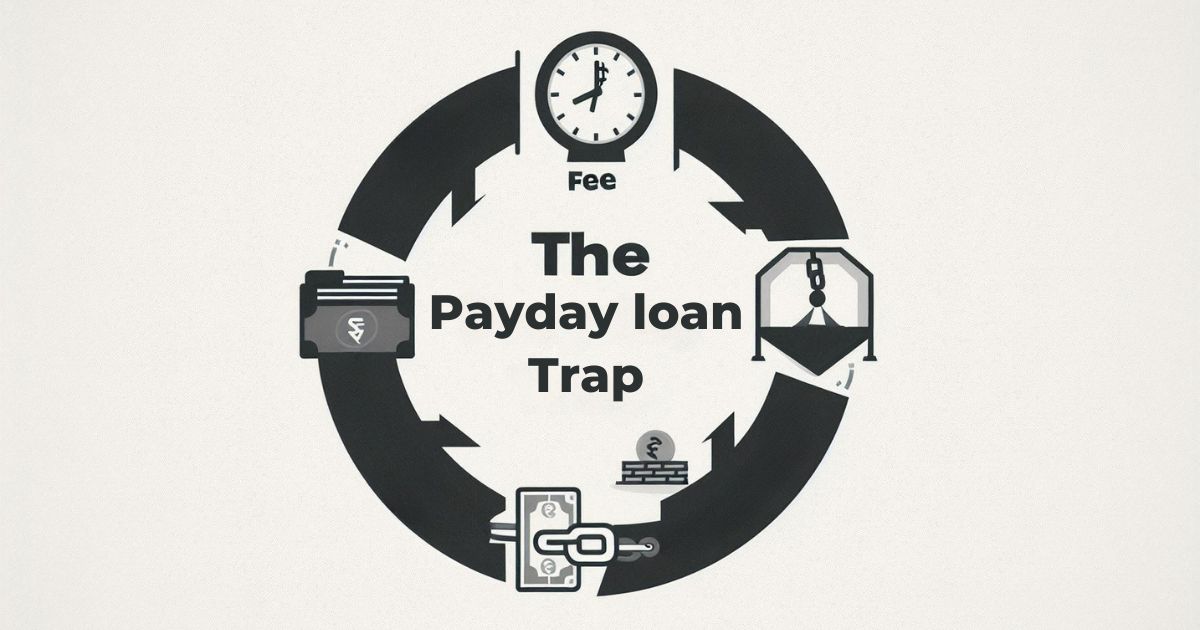

Payday loans may offer quick cash, but they come with high interest rates and serious risks. This blog explains what payday loans are, how to settle them, and safer alternatives. Learn your legal rights, smart repayment strategies, and how to break free from the debt cycle. Get informed before you borrow—your financial stability depends on it.

When you take out a loan, whether for a house, car, or education, you expect the process to go smoothly. But what happens if something goes wrong? If you find yourself in a dispute with your lender, it can be frustrating and confusing at times. This is where an ombudsman comes into play. Let’s break down what an ombudsman is and how they can help you in loan settlement disputes.

Loan settlement helps borrowers resolve debt for a reduced amount. Despite misconceptions, it’s a strategic option that prevents defaults, minimizes financial strain, and aids recovery.

In recent years, loan settlements have become increasingly intricate, often involving multifaceted legal and financial considerations. As more borrowers face financial distress, legal advocates have emerged as essential partners in navigating this process.

An important consideration when evaluating your creditworthiness for credit cards and loans is your CIBIL score. A poor score can seriously impair your ability to obtain credit, particularly after a settlement with a bank or other financial institution. Settlements, in which the lender agrees to accept a smaller sum than what was initially owed, are often used as a last resort to settle debt. Although this resolves the debt immediately, it negatively impacts your credit report and lowers your CIBIL score.