Borrower Rights & Legal Myths · 4 min read

Can You Be Arrested for Not Paying a Loan? Debunking the Myth

Many fear arrest for loan defaults in India. Understand civil vs. criminal law, RBI recovery guidelines, and when debt collectors cross legal limits.

Understanding the Legal Reality of Loan Defaults in India

Financial difficulty isn’t a rare case in an Indian environment, particularly against the background of inflationary pressure, unpredictable labour market, and healthcare emergency. Many borrowers are fearful that failure to repay a loan might put them in prison.

Such fear is frequently reinforced by aggressive approaches of recovery agents. Is loan default a legal thing to be arrested for in India? And now let us dispel the misunderstandings about the law.

Civil vs. Felonious Liability: The Foundation

Loan agreements represent an instance of civil contracts. When a borrower misses a loan, technically, it amounts to the breach of a contract, and it doesn’t indicate any criminal reimbursement, but a civil one. Indian legislation denies human beings the possibility to be jailed simply because he/she doesn’t pay a personal loan, credit card bill or EMI. The remedy of the creditor is filing a civil suit to recover or adjudicate; this is grounded on the terms of the loan.

The fear, however, emerges because of the misperception of the process of law and bullying characteristics of some of these agents that straddle between legal recovery and coercion.

When Non-Payment Becomes a Criminal Matter

Although default on a loan is a civil matter, there are some exceptions, and in those cases, it may be possible to apply criminal law. In case the borrower gives cheques in the direction of payment and such cheques bounce, then action can be taken under Section 138 of the Negotiable Instruments Act, 1881.

On the same note, when a borrower has gotten a loan through providing a forged document or has impersonated himself, then he can be tried under Section 406 (criminal breach of trust), 420 (cheating) or other sections of the Indian Penal Code (IPC) or Bharatiya Nyaya Sanhita (BNS), 2023.

However, such cases presume the intent to defraud or other crime, as it’s necessary to give evidence of actual fraud or will to defraud. And the fact that you can’t pay back because you’re in true financial difficulty isn’t a crime.

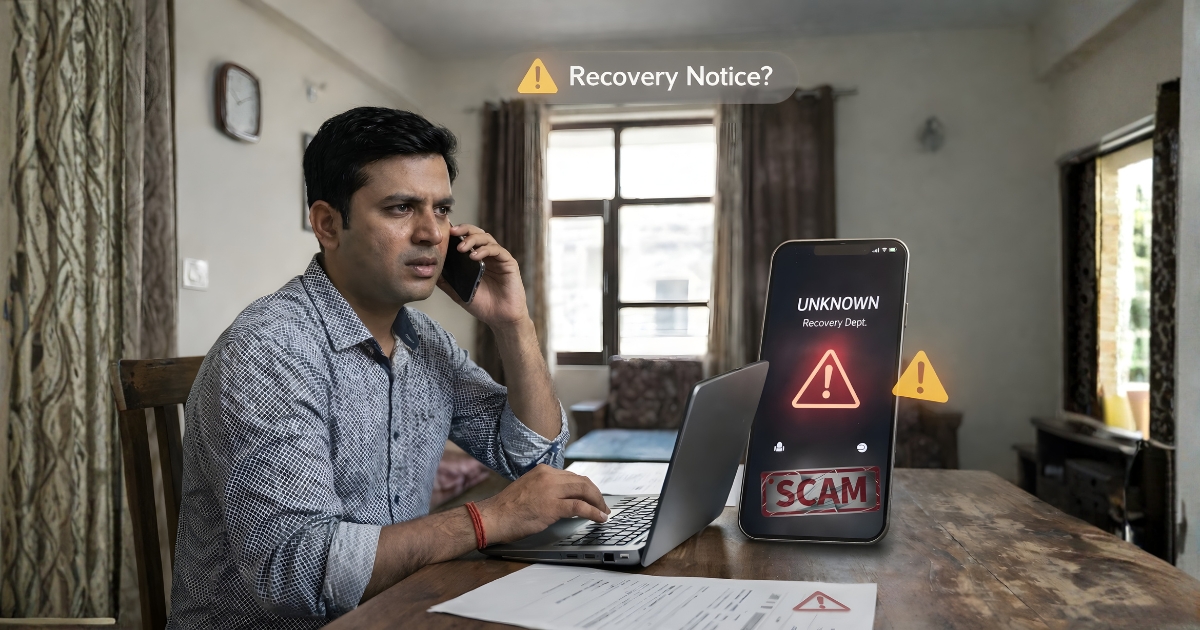

When Recovery Tactics Imitate Arrest: Psychological Harassment

In many cases, debt collectors claim to be police officers, or they state that there are some “clearances.” They can also apply fear-inflicting strategies by sending messages such as FIR is being filed, or the police are on their way. This kind of action is illegal and immoral.

Impersonating a public servant is a crime in Section 204 of the Bharatiya Nyaya Sanhita, 2023 (previously IPC), which is punishable with a jail term. A threat to arrest a person because he defaults on a civil loan, when no criminal case has been brought, is nothing more than intimidation and harassment.

Legal Boundaries for Recovery Agents

The Reserve Bank of India (RBI) has also come up with guidelines which need to be followed by all banks and the NBFCs. Recovery agents are not to threaten, abuse, or harass a borrower and their family. They are not allowed to call the borrower at odd hours of the day, speak in foul language or reveal the default to third persons such as the neighbours or colleagues of the borrower.

In case they do, the concerned borrower is entitled to bring complaints to the RBI, the nodal officer of the bank, police or even the National Human Rights Commission or the National Commission for Women, depending upon the case.

What the Courts Have Said

Over and over again, Indian courts have defended against coercive strategies against the borrowers. In ICICI Bank v. Shanti Devi Sharma, the Delhi High Court criticised the practice of lending to goons to get back loans.

On the same note, in K.S. Puttaswamy v. Union of India, the Supreme Court upheld the right to privacy of the borrower, whose conduct would be sending their photos as a form of recovery or calling their connections as an outright violation of privacy.

Conclusion: Know Your Rights, Don’t Fall for Myths

No, failing to pay a loan alone can’t result in arrest in India. Recovery of dues lies in the civil side, and unless fraud is proved or there’s any case of cheque bounce or criminal intention, there’s no point initiating a criminal offence. There’s also the fear of arrest, which is generally created by mischief recovery agents to intimidate borrowers.

When you’re experiencing financial distress, it will be prudent to negotiate with the lender, talk, or even go to court for relief. Don’t be intimidated into thinking that defaulting on a loan will result in jail. Be aware of your rights — they are your best defence.

_1_.E8kmHkSz.jpg)